Executive Compensation - The Legal Issues - Nonprofit Law Blog.

Excess compensation continues to be a focus area for the IRS because nonprofit executives may be able to increase or have significant influence on their compensation. This is a major risk to an organization because not only is the nonprofit executive liable for the excise tax on excess compensation, but those who approved the compensation may also be held liable.

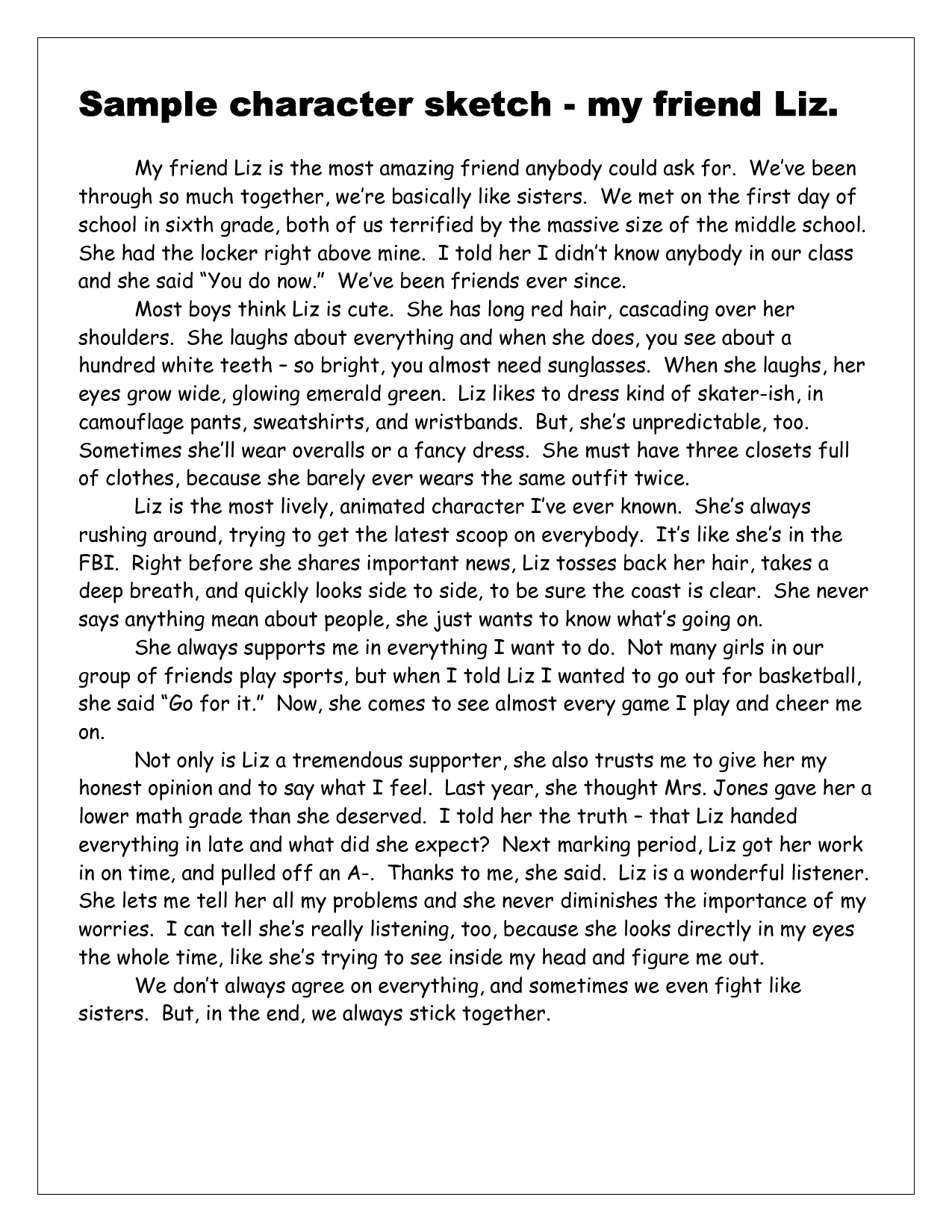

Sample Key Executive Compensation Arrangements Policy Notice: This sample policy document does not constitute professional advice and is not a subsitute for the law and regulations related to the topics addressed herein. Organizations are encouraged to consult with tax counsel in establishing compensation for their top.

The IRS says that a key employee who works for a nonprofit can only be paid a reasonable amount. Any amount above the reasonable threshold is an excess benefit that can result in IRS sanctions. Nonprofits would love to have concrete guidelines about how much is reasonable. Unfortunately, there aren’t any. The IRS simply says that compensation.

Essays on Executive Compensation and Managerial Incentives Xianming Zhou Doctor of Philosophy 1997 Graduate Department of Economics University of Toronto Abstract The first chapter of this dissertation examines the regdatory impact of executive compensation disclosure on managerial pay schemes. Analysing a three-level agency mode1.

Executive Compensation Policy. Introduction. The chief executive’s compensation package is an important component of a board’s responsibility for managing the executive. Putting together a compensation package is a complex activity. It is tied to who the chief executive is expected to be as a professional and to what the chief executive is.

Other posts on the site.

Essay Executive Compensation. Accounting Theory Assignment Executive Compensation (pic) Introduction Executive compensation together with corporate governance systems has received an increasing amount of attention- from the press, corporations, financial academics and also the government. An executive compensation plan is a major application of.

Performance of a worker is based on compensation from the company. Compensation should be measured by the level of expertise of a worker and the possible challenges faced by the responsibility required by the particular employee. In any business organization, hierarchy is indispensable. Senior and subordinate positions are therefore necessary.

What kinds of data should nonprofit executive compensation be based on? If you don’t know the answers to these questions—or if you do, but want to make sure your understanding is up to date—download a free copy of “What You Need to Know about Nonprofit Executive Compensation.” Prepared by GuideStar staff, the report addresses these.

Executive compensation is more than an executive’s salary, compensation includes an executive’s retirement plan, any deferred compensation, and other fringe benefits. Over the past several years, the IRS has increasingly investigated the executive compensation practices of nonprofit organizations. In addition, nonprofit executive compensation is a common risk-area flagged for audit by the.

Management Compensation Report for Not-for-Profit Organizations, published by PRM Consulting Group. IRS Publication 1053, Corporation Source Book of Statistics of Income. Executive Compensation Reports, published annually by the Research Institute of America. Surveys of executive compensation published annually in Bloomberg Business Week and.

Executive Compensation. Overview: Executive compensation analyses are significantly complex and need to be conducted in a systematic, defensible manner. Compensation Resources has been a leader in all areas of Executive Compensation for over 25 years. We are an independent facilitator, educator and partner and are committed to creating.